Is there a clear pathway to low-carbon marine fuels?

The International Maritime Organization’s (IMO) has set a new and more ambitious target to decarbonize shipping and achieve net zero by or around 2050. As the clock ticks, ship owners are more aware than ever that change is required, but the pathway to adopting renewable and low-carbon fuels is more of a long and winding road.

What’s driving maritime decarbonization?

The pressure to decarbonize is hitting the maritime industry from all sides. Public scrutiny of industrial pollution and greenhouse gas emissions grow daily. At the same time, governments and regulatory bodies the world over are setting increasingly strict targets for decarbonization. On top of this, shipping companies are under pressure from their clients – charterers and cargo owners – to contribute towards a drastic reduction in their scope 3 emissions in turn.

Already in force is the IMO’s Carbon Intensity Indicator (CII), which aims to gradually reduce carbon emissions from ships. As part of its short-term measures package, IMO has also newly implemented the Energy Efficiency Existing Ship Index (EEXI) to improve existing ships energy efficiency and reduce fuel consumption.

The EU, meanwhile, has adopted FuelEU Maritime, which imposes greenhouse gas (GHG) intensity limits on fuels used onboard and mandates onshore power supply in ports for container and passenger ships. FuelEU Maritime will apply from January 2025. From 2024, the EU Emissions Trading System (ETS), a cap-and-trade mechanism designed to reduce GHG emissions over time will also apply to ships travelling to, from and within EU waters. China has also set carbon-neutral targets for all industries by 2060, established domestic emission control areas and may soon extend its own ETS to include shipping.

Many of these regulations set stricter emissions targets over time with financial sanction systems, meaning that ship owners must act to keep their fleet economically operational in coming years. Carbon capture and wind-assisted propulsion are options that could be implemented in the short-term to provide some reduction in carbon intensity. However, ship owners will at some point be compelled to rethink their fuel choices if they want to truly decarbonize their fleet.

What are shipping’s options for low-carbon fuels?

Fuel contenders could broadly be split in two main categories:

- Carbon-based, which includes MGO, liquefied natural gas (LNG), liquefied petroleum gas (LPG) and methanol/ethanol

- Hydrogen-based, principally hydrogen and ammonia

The environmental footprint of each of these fuels could be significantly reduced if they are produced from biomass or from renewable sources.

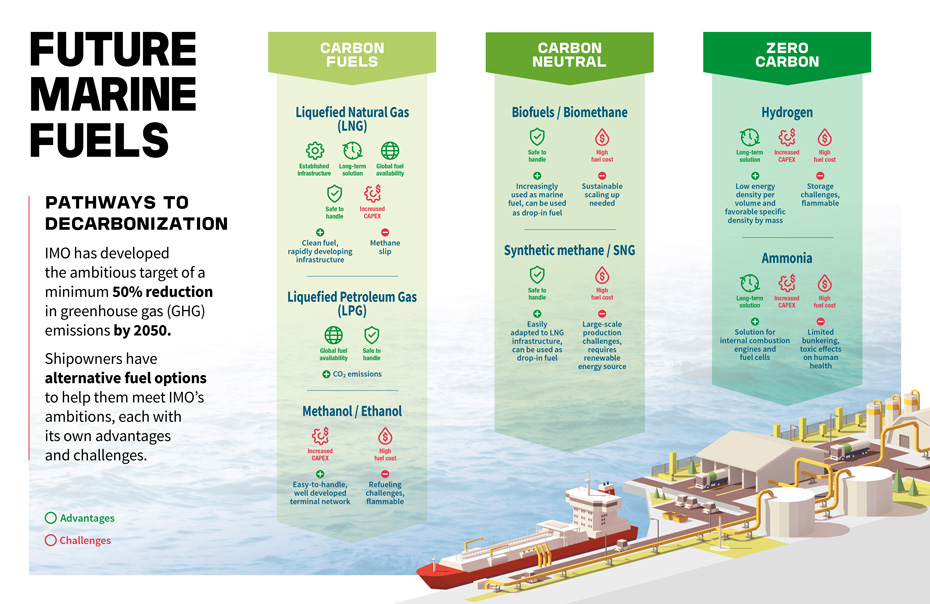

As shown in the infographic below, each of these fuels comes with its own advantages and challenges.

Download our Infographic

While all of these fuels are an improvement on fossil fuels, their low-carbon credentials also depend on how they are produced. The entire production process for each fuel, as well as distribution and use onboard, needs to considered from well to wake (W-t-W).

-

Liquefied natural gas

The alternative fuels frontrunner, LNG generates by combustion in engines almost no sulfur oxide or particulate matter emissions and creates low nitrogen oxides emissions. Its GHG emissions are between 7 and 22% lower than fuel oil depending on engine type. On the other hand, as a fossil fuel, LNG will only lower emissions, not eliminate them. There is also the risk of methane slip from incomplete combustion or of methane leaks, both of which cause concern as methane is a highly potent GHG. However, promising options to monitor and mitigate these risks are currently being developed.

-

Liquefied petroleum gas

LPG is both widely available and easy to handle and store, leading to lower CAPEX than with LNG. However, it too reduces but does not eliminate carbon output, and current production levels are not sufficient for shipping to rely on LPG as a catch-all solution.

-

Methanol and ethanol

These fuels are convenient to handle and enjoy a well-developed global terminal network. However, methanol produced from natural gas generates well-to-wake emissions which are worse than those of conventional fuel oil. While the CAPEX gap is smaller than for LNG, fuel costs may be less favorable when compared with LNG and LPG.

-

Biofuels, synthetic methane and substitute natural gas

Major maritime players have been testing biofuels as a low-carbon solution, but the mass-scale production of first generation biofuels is not sustainable. Second- and third-generation biofuels could be produced with fewer negative environmental impacts, but they are not yet produced at scale.

Synthetic natural gas (SNG) and bio-methane are also attractive options, but making them carbon neutral depends on the availability of renewable energy or relevant feedstocks, and production remains costly in the short term. -

Hydrogen and ammonia

Generating zero CO2 emissions when produced using renewably sourced electricity, hydrogen and ammonia are potentially zero-carbon fuel solutions for internal combustion engines or fuel cells. However, despite strong potential, both fuels have challenges or drawbacks that may impact costs, safety measures and ship design.

Ammonia, burns slowly with a high autoignition temperature. Its use in ship engines requires a pilot fuel – such as MGO or even biodiesel – which could impact CO2 output. Ammonia is both highly toxic and corrosive, even at low concentrations and therefore necessitates stringent safety measures. Another point of consideration is that ammonia combustion could produce nitrous oxide emissions, an extremely potent GHG. Finally, while engines able to burn ammonia are still under development, potential ammonia slip will also have to remain under scrutiny.

Why do production pathways matter?

Each of these alternative fuels has its own particular production method, and some generate more emissions than others. Traditionally, emissions from shipping have been measured “tank-to-wake”, taking into account only emissions from fuel combustion onboard the ship. In the short-to-mid-term, a newly adopted “well-to-wake” approach also considers upstream emissions – though it is not an approach taken in existing measures such as CII and EU ETS.

This change complicates fuel categorization. Hydrogen, for example, can be produced in a number of ways, changing its emissions profile. Types of hydrogen range from brown, produced from coal, through pink, generated with nuclear energy using electrolysis, to green hydrogen, created from renewable energy. Similarly, different generations of biofuels have different emissions profiles, and for each a host of other impact categories need to be taken into consideration, such as land use, and food supply.

Global Market Leader for Sustainable Shipping

Bureau Veritas M&O

At this stage, every solution is still on the table as the possible future fuel of choice. As the shipping industry explores its options and takes steps towards a greener future, Bureau Veritas is committed to helping clients stay informed, empowered and ready to make the right choice when the time comes.

What about fuel availability?

In the midst of these extensive efforts, it is important to remember that shipping is not alone in its decarbonization journey. Every other sector, including transportation, is facing similar scrutiny and regulations. As a result, shipping will find itself in competition for a supply of renewable and low-carbon fuels, which is likely to drive price increases.

Maritime industry players, particularly those with cargo carriers or tankers, need to limit OPEX if they are to remain competitive for their clients, so the issue of fuel cost may prove decisive. That said, fuel prices change rapidly, and the energy market is always fluctuating, making concrete long-term predictions extremely difficult.

A further complicating factor is the issue of infrastructure and supply for each of these fuels. As an established fuel in the shipping industry, LNG has the best-established global bunkering network. Currently 34 vessels supply LNG as a fuel, with a further 19 on order.[1] Methanol also benefits from a well-developed bunkering terminal network, and LPG from numerous import/export ports around the world. On the other end of the spectrum, bunkering infrastructure is much more limited for hydrogen and ammonia, and to lesser extent for biodiesel.

How Bureau Veritas is preparing for the future fuel mix

Bureau Veritas works to supports the development of a range of IMO regulations, from the International Code of Safety for Ships using gas or other low-flashpoint fuels (IGF code) to industry design, operations and bunkering standards. Through in-house, Joint Industry and Joint Development Projects, we constantly engage in research and development to gain greater understanding of the technical feasibility of and safety risks involved in the use of alternative fuels.

Our experts also support technology developers by providing Approvals in Principle for new designs. In addition, we have issued Class Rules for the use of fuels onboard along with specific notations for vessels preparing to use low-carbon fuels. These include NR 529 for gas-fuelled ships, NR 670 for methanol- and ethanol-fuelled ships, NR 671 for ammonia-fuelled ships, and NI 647 for LPG-fuelled ships.

[1] Safety4Sea World LNG report 2023