EU Emissions Trading System (EU ETS)

EU ETS at a glance

Initially, the EU Emissions Trading System (ETS) was part of a European Directive (2003/87/EC) designed to lower greenhouse gas (GHG) emissions. In line with the EU Green Deal, the Fit for 55 package aims to reduce the EU emissions by 55% in 2030 compared to a 1990 baseline.

The Fit for 55 package extends the existing ETS to new sectors, including shipping. As a result, the shipping industry will need to mitigate its emissions. The emission trading system aims to reduce the total volume of GHG emitted over time. It is implemented through a “cap and trade” mechanism, meaning that every registered emitter must buy allowances corresponding to their emissions through an auction system. Prices per ton of emissions will generate revenues to partially finance the decarbonization of the maritime sector.

Vessels that fall under the scope of the regulation have already begun collecting GHG emissions under the EU Monitoring, Reporting and Verification Regulation (2015/757) (EU MRV). This regulation paved the way for the implementation of the new market-based measure.

The Directive and the Regulation were published in the EU Official Journal on 16 May 2023 and entered into force on 5 June 2023. Amendments apply from 1 January 2024.

-

What are the next steps in the legislative process for EU ETS?

The Directive and the Regulation were published in the EU Official Journal on 16 May 2023. Both legislative acts will enter into force on 5 June 2023. However, the Directive and the Regulation will apply from January 1, 2024.

The secondary legislations implementing EU ETS

Specific to EU ETS

- Commission Delegated Regulation 2023/7112 and annexes amending Delegated Regulation 2019/1122 as regards the functioning of the Union Registry to reflect the integration of the maritime sector

- Commission Implementing Regulation 2023/2599 laying down rules for the administration of shipping companies by administering authorities.

- Commission Implementing Regulation 2023/2297 identifying non-EU neighbouring container transhipment ports. (Port Saïd and Tanger Med)

- Commission Implementing Decision 2023/2895 laying down the list of islands and transnational maritime routes under public service contracts or obligations subject to derogations

- Commission Implementing Decision 2024/411 on the list of shipping companies with their respective administering company within an EU Member State

Specific to the MRV

- Commission Delegated Regulation 2023/6728 and annexes establishing rules and calculation methods for monitoring and reporting greenhouse gas emissions for maritime transportation. (Revision of MRV annexes I and II)

- Commission Delegated Regulation 2023/6748 establishing rules on the reporting of aggregated emissions data at company level.

- Commission Delegated Regulation 2023/2917 establishing rules on the verification activities, accreditation of verifiers and approval of monitoring plans by administering authorities repealing Delegated Regulation 2016/2072

- Commission Implementing Regulation 2023/2449 laying down rules as regards templates for monitoring plans emissions reports at company level.

-

What does “cap and trade” mean?

The publication of the list of companies under EU ETS in February 2024, means participants will now be able to purchase sets of emission allowances for the coming years. This list will be updated every two years.

Participants can only emit up to the amount covered by their allowances. If they don’t have enough to cover their needs, they can purchase additional allowances.

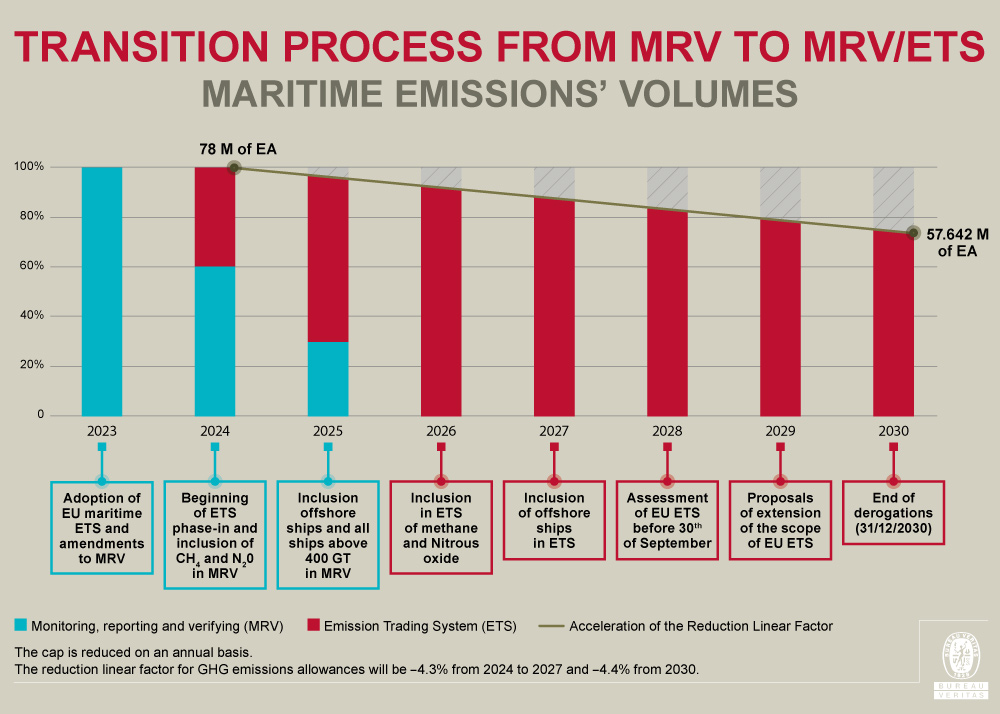

The cap is reduced on an annual basis. The reduction linear factor for GHG emissions allowances will be -4.3 % from 2024 to 2027 and -4.4 % from 2028. -

Which type and size of ships will be included in the EU ETS?

The EU ETS will impact the following ship sizes and types regardless of their flag:

- From 2024: cargo and passenger ships of 5,000 gross tonnage (GT) and above

- From 2027: large offshore service ships (over 5,000 GT)

- From 2027: offshore ships and general cargo ships above 400 GT may be included based upon a report by European Commission

-

Which emissions will be considered?

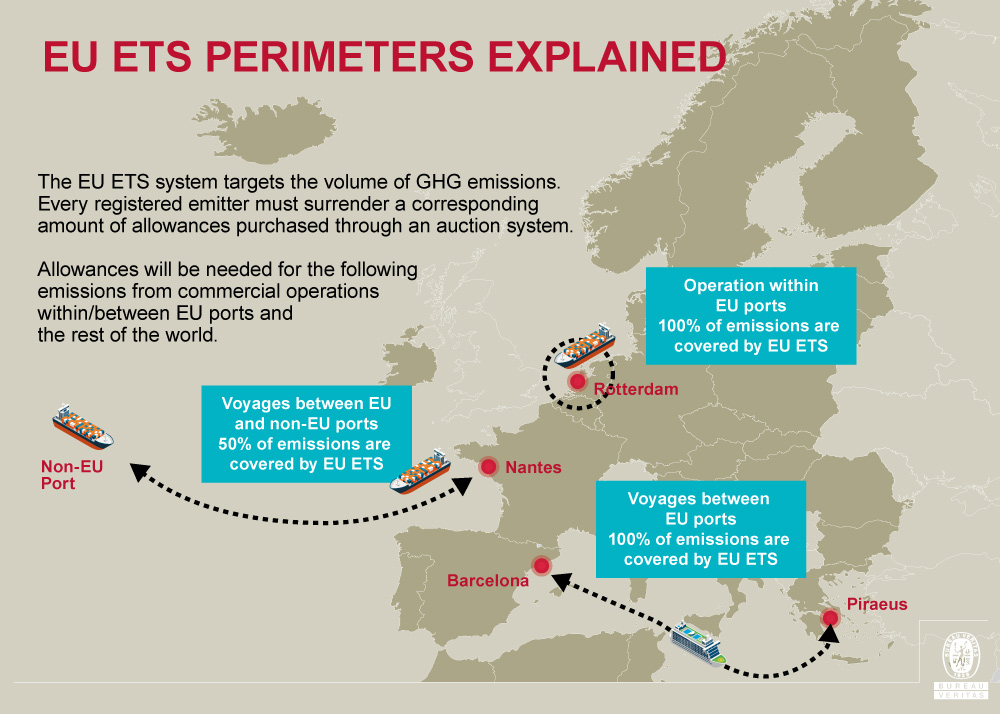

Allowances will be needed for the following emissions from commercial operations (passengers/cargo transportation):

- 100% of the emissions from ships travelling between EU ports

- 100% of the emissions at berth in EU ports

- 50% of the emissions for ships travelling between an EU port and a port outside the EU

- Exemptions for dry-docks and other maintenance/emergency reasons

Download our infographic

-

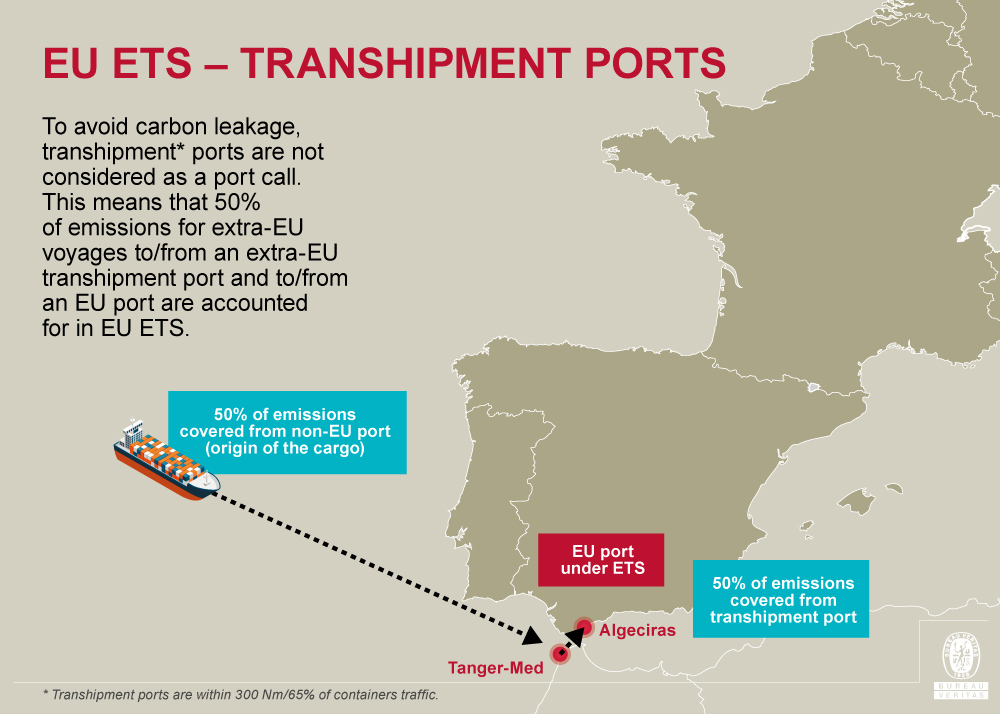

How does EU ETS account for carbon leakage from a transhipment port?

To avoid carbon leakage, transhipment ports will not be considered as a port call. This means that 50% of emissions for voyages to/from a transhipment port outside the EU and to/from an EU port shall be accounted for in EU ETS.

The European Parliament and the Council defines a transhipment port as a neighboring container transhipment port where the share container transhipment exceeds 65% of the total container traffic during the most recent twelve-month period for which relevant data is available. It should be noted that:- Containers are measured in twenty-foot equivalent units

- Transhipment ports can be located outside the EU as long as they are less than 300 nautical miles from a port under the jurisdiction of a Member State

The European Commission published the list of neighbouring container transhipment ports designating Tanger Med and Port-Said. This list will be updated before 31 December every two years thereafter.

-

What are the key dates for the phase-in of the EU ETS?

The phase-in period will start from January 1st, 2024, with:

- 40% of the verified emissions covered in 2024

- 70% of the verified emissions covered in 2025

- 100% of the verified emissions covered in 2026

-

How will EU ETS be implemented in EU MRV?

Shipping companies will have to continue reporting their GHGs emissions through the updated MRV platform. The diagram below explains how the EU MRV will change into EU ETS: verified emissions change into allowed and traded emissions.

-

What are the first steps to be compliant?

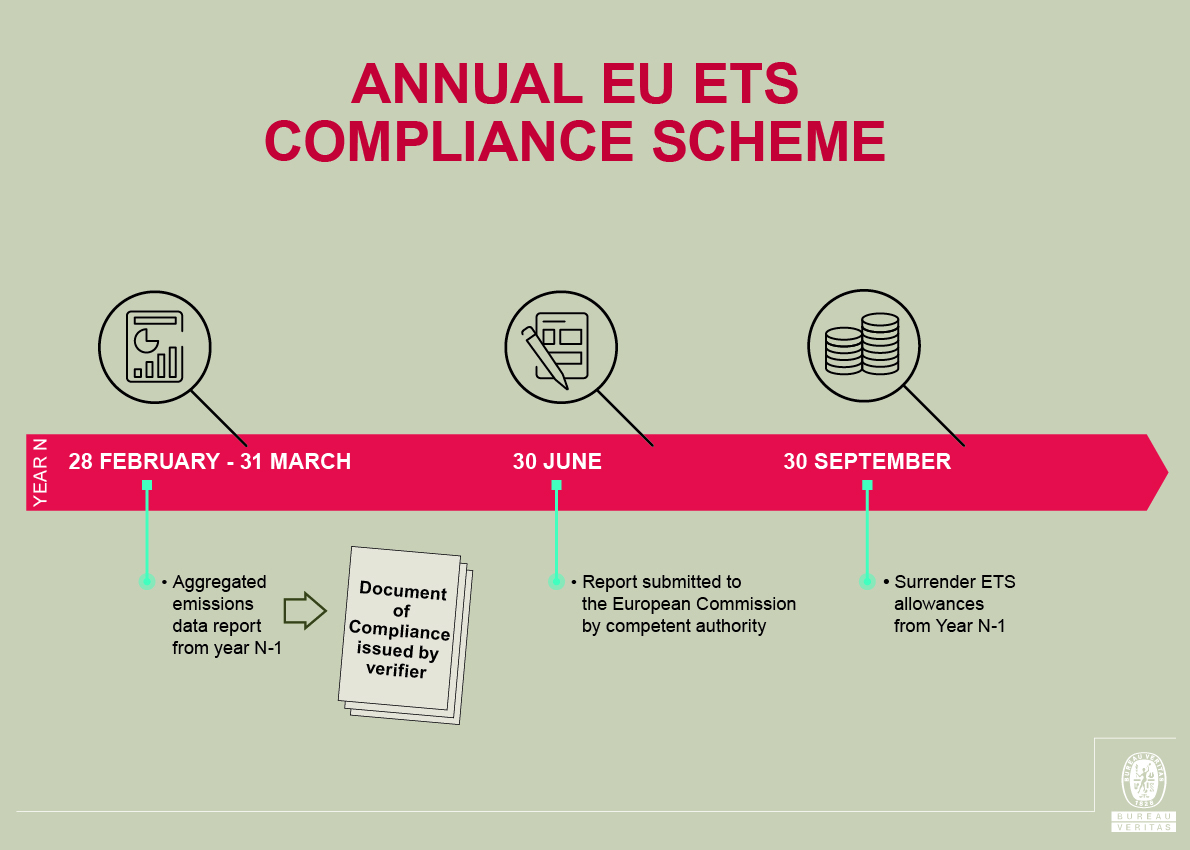

The EU ETS compliance scheme is set on an annual basis.

First, the EU MRV plan must be updated within 3 months from January 2024. The plan must be monitored by an accredited verifier and submitted for approval by April 1, 2024 to the shipping company’s administrative authority. It should reflect the inclusion of CH4 and N2O emissions within the scope of this Regulation.

The shipping company will be administered by an EU Member State’s administrative authority according to:- its flag;

- the number of its port calls in a Member State;

- or its first call in an EU Port.

The list of shipping companies with the respective administering authority will be set in February 2024.

The shipping company will appoint an accredited verifier at the fleet level.

From January 1, 2025, the shipping company will have to monitor its fleet’s individual GHG emissions. Then, by March 31, 2025, the company must submit a report to the administering authority.

Finally, by September 30, 2025, the shipping company will have to surrender 40% of CO2 emissions emitted in 2024. -

How to Manage EU ETS Accounts?

Maritime operators holding accounts (mandatory)

To open a holding account, operators must submit supporting documents to the national administrator responsible for overseeing the greenhouse gas emission registry on behalf of its respective Member State (administering authority). The national administrator is only responsible for the opening and maintenance of holding accounts, whereas the administering authority oversees account compliance with the European Union (EU) Emissions Trading System (ETS). The list attributing shipping companies to their respective administering authority will be published by mid-February 2024.

Examples of national administrators include: the German Emission Trading Authority, the Dutch Emissions Authority, the Malta Resources Authority, the French Caisse des Dépôts et Consignations, the Belgian Climate Change Department of the Federal Public Service of Public Health, and the Swedish Energy Agency.

At least two natural persons will be designated to manage the account as legal and authorized representatives. Account transactions adhere to the "four eyes principle," wherein one representative initiates a transaction by registering it, and the other verifies and provides final approval.Trading accounts (voluntary)

Each Member State establishes its own requirements for prospective trading account holders. These requirements relate to permanent residence, VAT registration, and business registration.

Shipping companies based outside the EU can create a subsidiary that meets their administering authority's requirements, or they can mandate an EU-based company to manage a trading account on their behalf. A single trading account can serve multiple companies with individual holding accounts, even if they are registered with different administering authorities.Time period for opening an account (holding & trading)

EU law requires that the opening of an account be processed within 20 working days of receipt of the full set of required documentation.

Account fees (holding & trading)

Each Member State, in accordance with its national administrator, fixes its own account maintenance and transfer fees annually.

Sanctions for non-conforming holding accounts (not applicable to trading accounts)

Account-holders are responsible for the conformity of their accounts. They can either be the shipowner or an International Safety Management (ISM) company, that is mandated by the shipowner and that has agreed to assume the responsibilities associated with the EU ETS.

-

What happens if a ship is chartered to another shipping company?

The EU ETS system shall be based on the shipping company’s identity, not the ship itself.

The owner will be responsible for surrendering allowances but can contractually pass on the costs to another entity operating the ship (making them accountable for the emissions voyages covered by EU ETS). -

What are the derogations from EU ETS?

Until December 31, 2030:

- Ships with ice-class IA or IA super, or equivalent, may surrender 5% fewer allowances.

- Some emissions are excluded on voyages by passenger and ro-pax:

- between an EU port on an island with fewer than 200,000 permanent residents where there is no road or rail link with the mainland and a port of the same State, and from their activities within a port;

- when performed as part of a transnational public service contract or obligation between two EU ports, and from their activities within a port;

- between an EU port located in an outermost region and a port of the same State, and from their activities within a port.

-

Will CO2 captured onboard be deducted from the EUA that must be surrendered?

GHG emissions that are not directly released into the atmosphere shall be included in the EU ETS and corresponding allowances must be surrendered, unless:

- they are stored in a storage site in accordance with Directive 2009/31/EC of the European Parliament and of the Council;

- they are permanently chemically bound in a product so that they do not enter the atmosphere under normal use and any normal activity occuring after the end of the life of the product.

Delegated acts by the Commission will specify the conditions for considering GHGs as permanently chemically bound in a product so that they do not enter the atmosphere, This may include obtaining a carbon removal certificate, where appropriate, in view of regulatory developments regarding the certification of carbon removals.

-

How will biofuels and e-fuels be considered?

The accounting of the annual tank-to-wake GHG emissions data requires shipping companies to apply the methodology and default emission factor values in Annex I of Commission Delegated Regulation 2023/6728 amending the MRV annexes.

As for the accounting of tank-to-wake emissions from fossil fuels, a reference in FuelEU Maritime only prevents shipping companies from diverging only from the default CO2 emission factor value. However, divergence from default CH4 and N2O emission factor values (including fugitive and slip emissions) is allowed, provided that the actual values are certified via laboratory tests or direct emission measurements.

An additional derogation is granted by the revised MRV annexes for biofuels meeting both sustainability and GHG savings criteria. These criteria require a 70% reduction compared to the emissions value of the fixed transport fuel comparator established in the Renewable Energy Directive (RED). In such cases, the CO2 emission factor of the biomass fraction of the fuel shall be zero.

Details for the consideration of CO2 emission factors for other low-carbon fuels (RFNBO and RCL) are set to be further defined through the revision of Implementing Regulation (EU) 2018/2066. -

What are the penalties for non-compliance?

The penalty, enforced by authorities of EU Member State, for excess emissions will be €100 per metric ton equivalent emitted. Moreover, the operator remains under the obligation to purchase the corresponding quantity of allowances for emitted emissions.

In case of persistent non-compliance for two or more consecutive reporting periods:- expulsion orders may be issued at the port of entry in case of non-compliance

- flag detention order until the shipping company fulfills its obligations (for ships under an EU Member State Flag within a port in that Member State).

-

Where will the revenues from EU ETS go?

The revenues generated from the sales of 20 million CO2 certificates will be included in the Innovation Fund and redirected to the renewal of ship fleets.

The rest of the revenues will be redirected to EU Member States for the decarbonisation of the maritime sector and climate change purposes. -

Will the EU ETS be revised?

The EU ETS will be revised in case of adoption by the IMO of a global market-based measure. Within 18 months of the adoption of such measure, the European Commission will present a report to the European Parliament and to the EU Council.

In that report, the Commission will also consider the measure as regards to :

- its ambition in light of the Paris Agreement objectives;

- its overall environmental intergity;

- any issue related to the coherence between the EU ETS and the IMO measure (avoiding double burden).

If appropriate, the report will be accompanied by a legislative proposal to amend the EU ETS Directive.